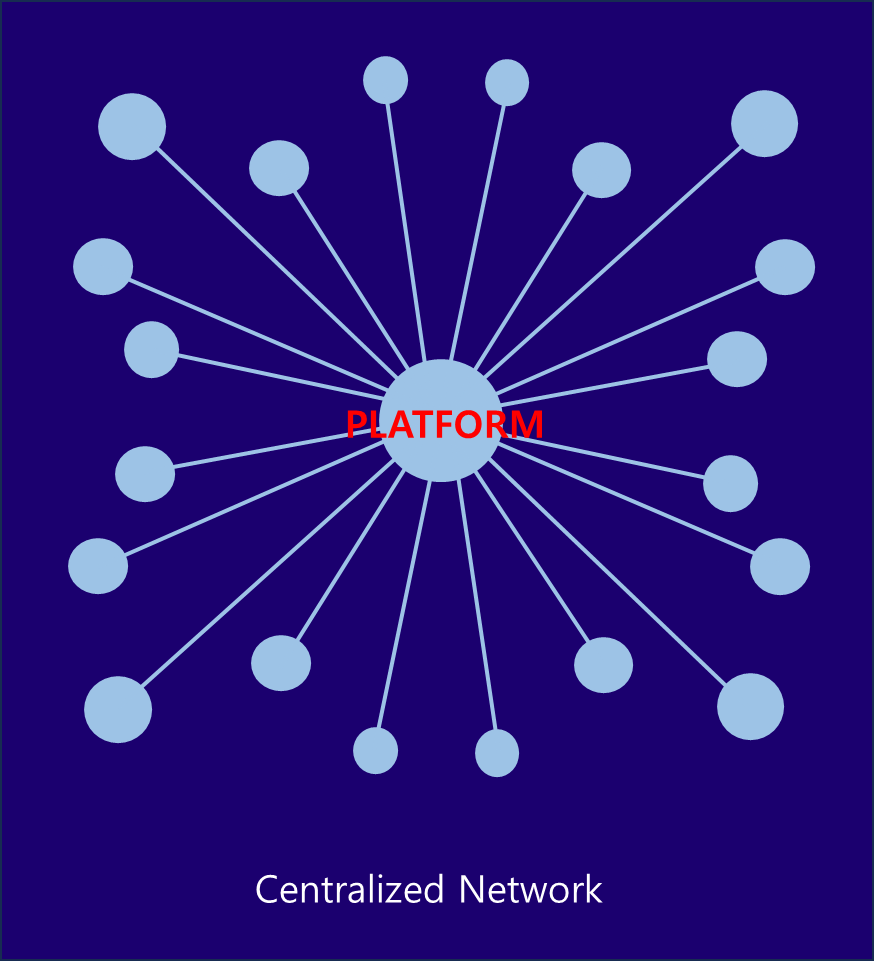

[Web2.0 Platform]

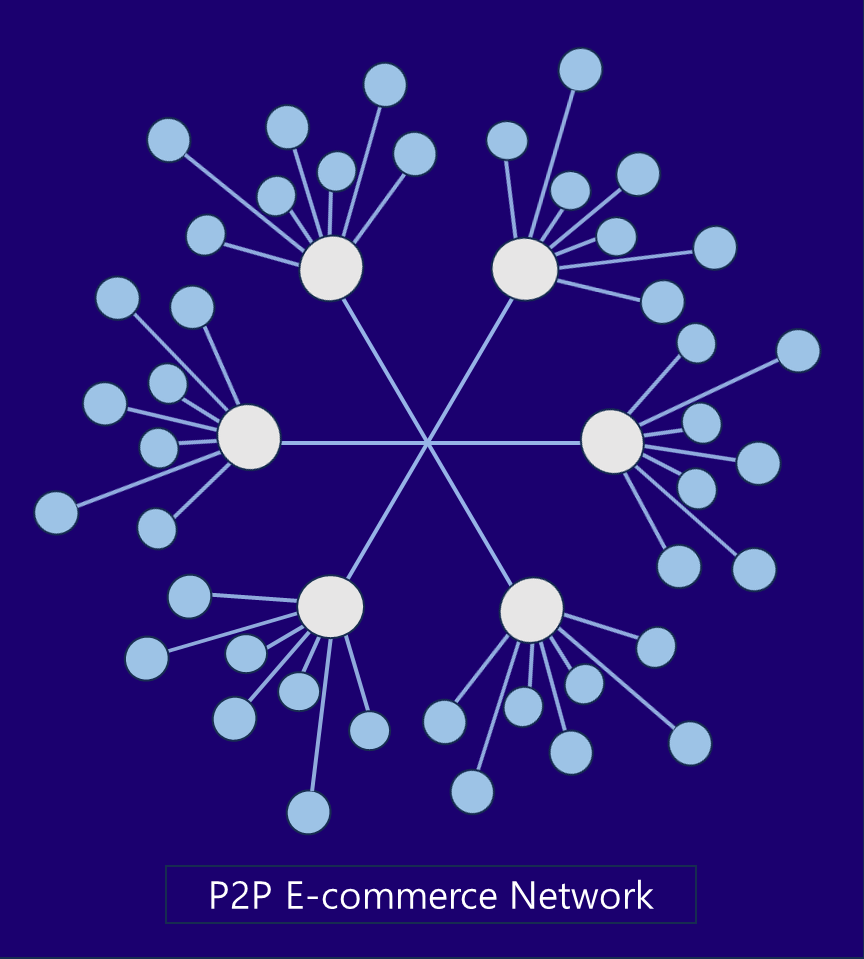

Now that the concept of decentralized e-commerce has been created, the platform should be called centralized e-commerce. Centralized platforms have expanded through the dot-com and mobile revolutions, providing consumers with unprecedented benefits. However, it is also true that excessive brokerage costs have been passed on to consumers, and problems have been created by indiscriminate information collection and sale of collected information for efficiency.

A centralized platform evolves into a marketplace in its own right. As the platform grows and establishes itself, it may experience the lock-in effect, making it challenging for other market participants to easily break through this solidification.

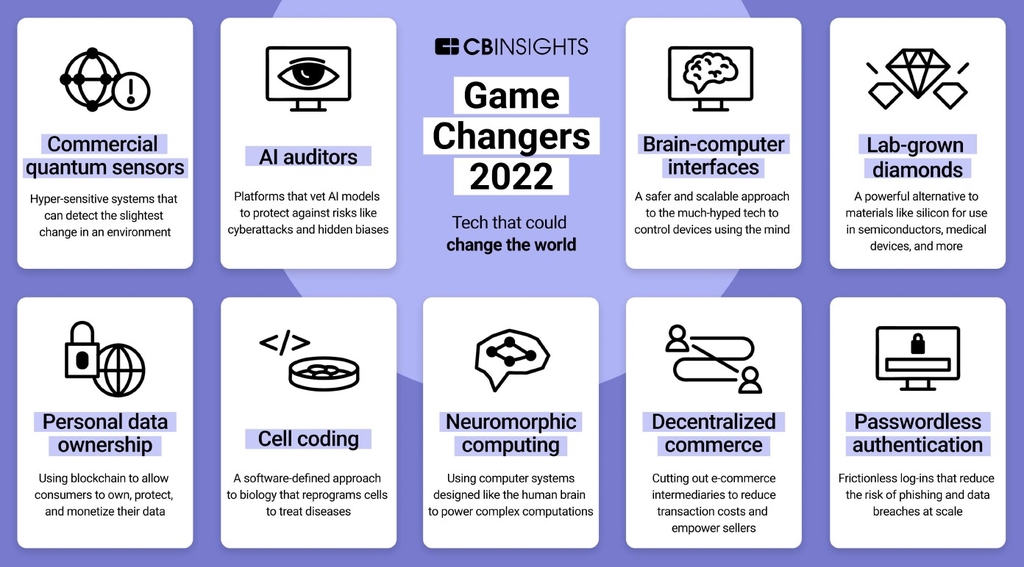

There are two approaches for new platform entrants to displace incumbent platform operators.

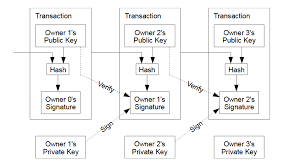

One is a more powerful centralization method using technology such as artificial intelligence (AI) and the other is decentralization.

.png)